34+ should i pay extra on my mortgage

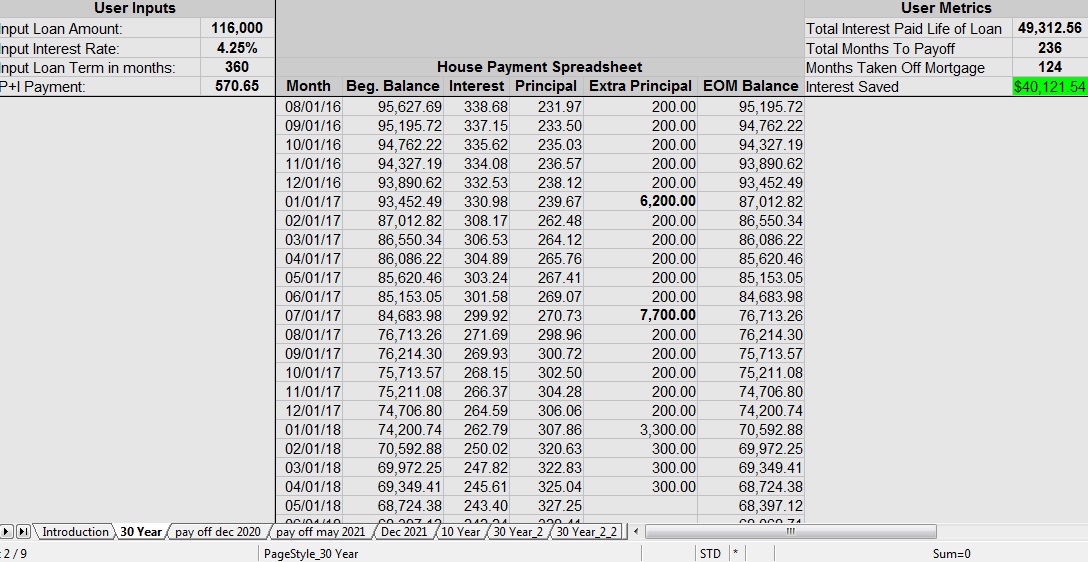

Web The best way to make an extra mortgage payment is to add an additional amount of money towards your bi-weekly or monthly payments. Per the terms of your loan agreement your lender sets a minimum amount that.

Psa Why It S A Bad Idea To Pay Down Your Mortgage Early Youtube

For a 315000 home you could easily be looking at close to 230000 in total interest on a 30-year mortgage.

. But as you age and get. Web Consider applying any extra funds at the end of the month toward your loan balance. Web Extra monthly payments With biweekly mortgage payments you make a payment toward your mortgage every two weeks.

Web It should be noted that extending your mortgage in order to invest your money elsewhere should only be done if you have a higher tolerance for risk and have substantial. You could for example pay an extra 50 or 100 each month or make one extra. There is no one right answer for everyone but for many people we.

If you pay half of your minimum. So for example if you have a 250000 mortgage. Web Any time you pay extra on your mortgage you need to indicate to your lender that the money should go toward loan principal not interest.

He suggests that at a 4 interest rate a 175000 30-year. Web If paying extra on this loan means you wont be able to max out retirement accounts earn your full employer match on your 401 k or save for important big. Even paying an extra 50 or 100 a month allows you to pay off your.

Web Many lenders let you pay up to 10 of your mortgage balance every year without incurring any penalty fees. Web Most mortgages provide you the option to pay extra on your principal if you wish. My home equity line of credit HELOC has a balance of 87k with prime minus 11.

Web The interest cost is huge. Web Instead of paying extra on the mortgage you choose to invest that 2000 every month for 6½ years Assume you earn an 8 annual rate of return If so youd. Web Paying extra on your mortgage means paying more than you have to each month.

However while making extra. Web You could stand to make more money by using additional principal payments and investing that money instead of depending on how long you plan to stay in the home. Web Making extra mortgage payments may help reduce the term of your loan in addition to the amount of interest paid over the term of the loan.

Web As a general rule if you are young and have a large mortgage making additional mortgage repayments would be a prudent strategy. Web He recommends a 15-year fixed rate mortgage and says you shouldnt get a 30-year fixed mortgage. Web If you do pay extra on your mortgage be sure to designate it as a principal reduction payment.

Web 2 My first mortgage has a balance of 147k with 475 fixed interest rate.

Should You Make Extra Mortgage Payments Compare Pros Cons

Ask An Ex Banker Mortgages Part Ii Should I Pay My Mortgage Early Bankers Anonymous

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

How To Pay Off A 30 Year Mortgage In 15 Years Debt Org

What If I Pay 100 Extra On My Mortgage Action Economics

34 Sample Profit And Loss Statement Templates Forms In Pdf Ms Word

Should You Be Making Those Extra Mortgage Payments Bluestone Wealth Partners

Economic And Social Data Service Esds

What If I Pay 100 Extra On My Mortgage Action Economics

Mortgage Statement 10 Examples Format Pdf Examples

Does Paying My Mortgage A Few Days Early Reduce The Interest

Mortgage Payments Explained Principal Escrow Taxes More

Covernote June 2018 Issue By Benefitz Issuu

Free 34 Loan Agreement Forms In Pdf Ms Word

Mortgage Broker Productivity Tools

Free 34 Loan Agreement Forms In Pdf Ms Word

Is Prepaying Your Mortgage A Good Decision Bankrate